05-1-2023 |

How Business Entities Held In Trusts are Treated Under the Corporate Transparency Act

By: Robert D. Hodges & Katheryn J. Thorson

The Corporate Transparency Act (“CTA”) is a new law coming into effect January 1, 2024, that implements reporting requirements for limited liability companies (LLCs), corporations, and other business entities that have never had to report such information previously.

BrownWinick attorney Brennan Block outlines the main components of the CTA in this article. If your trust holds an interest in a business entity, there are additional considerations and analyses your attorney will have to undertake to determine which individuals need to report information under the CTA. This article addresses the CTA’s implications for trusts and estate planning.

What Must be Reported under the CTA?

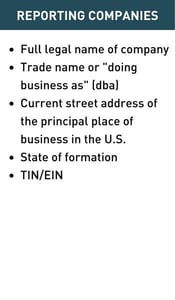

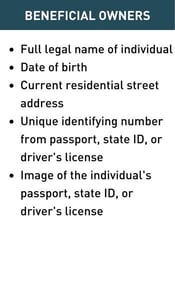

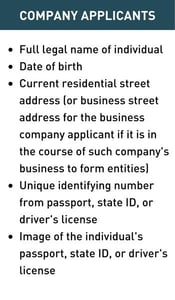

In general, the CTA requires a reporting company to disclose specific information regarding (1) the company itself, (2) its beneficial owners, and (3) the company applicants to U.S. Dept. of Treasury’s Financial Crimes Enforcement Network (FinCEN). The purpose of this new act is to prevent fraud or criminal activities through the use of shell companies.

For Iowa-based entities, here is a chart of who must report what under the CTA:

Note, no company applicant information needs to be provided for entities formed prior to January 1, 2024.

If any of the above information changes, you must file an updated report with the new information within 30 days of the change occurring. This could be an updated address for someone who moves, or an updated driver’s license image if someone renews their driver’s license.

Who Must Report under the CTA?

Reporting Company

What qualifies as a reporting company? A reporting company is a corporation, limited liability company, or other similar entity that is created by filing a document with the Secretary of State. It applies to foreign entities as well. Entities that are highly regulated (such as banks, insurance entities, and accounting firms) are exempt from the reporting requirements. Charitable entities and large operating companies (defined as having more than 20 full-time employees, $5 million in gross receipts or sales, and a physical office in the U.S.) are also exempt from reporting requirements.

Are trusts reporting companies? Most trusts are not reporting companies because they are not formed by filing a document with the Secretary of State.

Beneficial Owner

Who is a beneficial owner? A beneficial owner is an individual who, directly or indirectly, (1) exercises substantial control of the reporting company, or (2) owns or controls at least 25% of the ownership interest in the reporting company. Substantial control could mean that the individual serves as a senior officer, has authority to appoint or remove a senior officer, or has substantial influence over important decisions made by the reporting company, among other things.

Can a trust be a beneficial owner? If a trust owns 25% or more of a reporting company or has substantial control over the reporting company, a trust is a beneficial owner. Note, the trust itself will not be the beneficial owner because the beneficial owner must be an individual. The terms of the trust would have to be reviewed by an attorney to determine who is the beneficial owner if a trust has substantial control or ownership over a reporting company.

For example, the trustee will likely be the beneficial owner on behalf of the trust if the trustee has authority to dispose of trust assets or vote the shares held by the trust. However, the beneficiaries or settlor could also be beneficial owners. If a beneficiary is the sole permissible recipient of income and principal of the trust, or if the beneficiary has the right to withdraw substantially all of the trust assets, then the beneficiary would also qualify as a beneficial owner. The settlor could be a beneficial owner if the settlor has the right to revoke the trust or withdraw the assets of the trust. This analysis can get complicated quickly and it is not clear how the new rules will be interpreted as they apply to each type of trust.

There are a few exceptions to beneficial owners as well:

- A minor child will not be a beneficial owner, but their parent or guardian could be. Furthermore, when the minor child reaches the age of majority, an updated report will have to be filed within 30 days of their reaching the age of majority.

- An individual whose interest in a reporting company is a future interest through a right of inheritance will not be considered a beneficial owner. Thus, future beneficiaries of a trust that holds more than 25% of an LLC will not be beneficial owners (yet).

- An agent or other individual acting on behalf of an individual will not be considered a beneficial owner.

- A creditor of a reporting company will not be considered a beneficial owner.

Company Applicant

Who is a company applicant? A company applicant is the individual who files a document with the secretary of state that forms the reporting company. For example, the attorney who files the certificate of organization with the secretary of state to form an LLC would be the LLC’s company applicant. If an attorney directs a paralegal to file the formation document, both would be considered company applicants.

Deadlines and Penalties

A reporting company created prior to January 1, 2024, has one year, or until January 1, 2025, to file its initial report. A reporting company created after January 1, 2024, must file its initial report within 30 days of forming the company with the Secretary of State. Keep in mind, there are fines and criminal penalties for not reporting or for reporting inaccurate information, so this is not something you want to ignore.

If you own a business in Iowa, or if you formed an entity to hold your vacation home, you should contact me or your business attorney regarding your obligations under the CTA. Additionally, if your business entity is held by a trust, you should contact me or your estate planning attorney to ensure you are reporting the correct information under the CTA.

The material contained in this communication is informational, general in nature and does not constitute legal advice. The material contained in this communication should not be relied upon or used without consulting a lawyer to consider your specific circumstances. This communication was published on the date specified and may not include any changes in the topics, laws, rules or regulations covered. Receipt of this communication does not establish an attorney-client relationship.