10-16-2023 |

GOVERNMENT RELATIONS UPDATE - 10-12-2023

By: BrownWinick

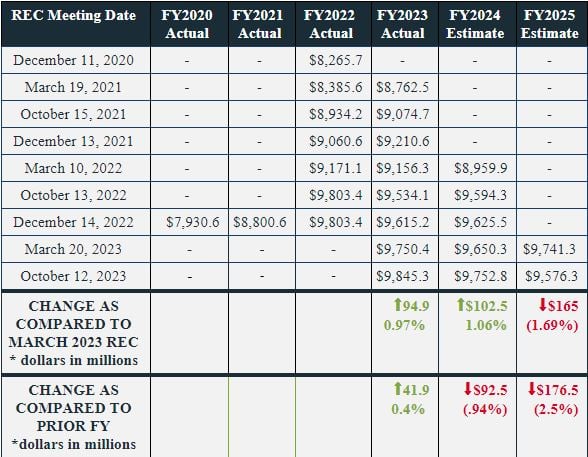

The Revenue Estimating Conference (“REC”), comprised of a three-member panel (Kraig Paulsen, David Underwood, and Jennifer Acton), met Thursday (10/12/23) as part of its standard schedule of meetings to estimate future state revenues. A summary of the information discussed during the meeting is below, along with the linked spreadsheet distributed following the meeting that contains more detailed revenue information. You can also view a recording of the full meeting HERE.

Important to Note:

The REC’s number for fiscal year 2024 (“FY”) is higher than the March 2023 estimate by $102.5 million (1.06%). Recall, Governor Reynolds uses the December estimate to prepare her budget, and the Legislature is required to use the lower of the December or March estimates for its FY25 budgeting.

Summary:

Iowa’s revenues increased modestly over the past year. Specifically, FY23 revenues concluded the year higher than expected by $94.9 million (0.97%) and grew by over $41.9 million as compared to FY22 actual revenues, which equates to 0.4% growth. Importantly, the October REC estimate also accounts for the future impact of the recent tax reform, which will reduce state revenues in future years due to lower tax rates - estimated to result in $92.5 million fewer dollars in FY24 as compared to FY23 (equating to a 0.94% decrease in revenue growth for FY24). The REC estimated further decrease for FY25 ($176.5 million or 2.5%).

General Comments From the REC Regarding Factors Impacting Estimates:

- Internationally, the strained relationships between the U.S. and China continue and volatility continues in the Middle East. The Russia/Ukraine war continues to contribute significantly to global economic turmoil.

- Despite these challenges, the U.S. economy has continued to remain remarkably resilient despite elevated inflation, higher interest rates, and higher food and fuel prices.

- The biggest driver to the economy’s strong performance has been consumer discretionary spending as consumer spending accounts for approximately 70% of the national economy.

- Consumer spending has remained strong and retail e-commerce sales are reporting the highest growth since the onset of the pandemic in 2020.

- The Federal Reserve has indicated that interest rates may have to stay higher for longer as inflationary prices remain elevated. However, inflation has started to moderate since peaking at 9.1% in June of 2022.

- According to the U.S. Labor Department, the annual inflation rate for the U.S. was 3.7% as of August 2023 which is down from 8.3% one year ago.

- The labor market is starting to show signs of slowing but continues to be strong. Businesses and companies have continued to remain confident by adding workers at higher pay to get back to pre-pandemic levels.

- The most recent federal monthly jobs report for September showed the U.S. economy added 336,000 jobs and the national unemployment rate was 3.8%.

- Iowa is showing a modest slow down in revenue, but is still on very solid financial footing with full reserve funds. The slow down are planned reductions driven by the state tax rate reductions for Iowa taxpayers.

- The state's GDP grew 5.2 percent in the first quarter of 2023 and consumer spending is expected to keep sales tax receipts high,

- Iowa’s non-farm employment peaked in April 2023 at 1.6 million jobs though August 2023 employment was down 8,600 jobs from the peak.

- Iowa’s unemployment rate is 2.9% and the labor force participation rate is 68.27%. A continuing issue is more jobs than workers and an aging workforce.

- Drought conditions have persisted over much of the year. Harvest has begun for both corn and soybean and yields are anticipated to vary across the state due to the drier weather conditions.

- Iowa’s farm economy appears strong despite the drought conditions, lower livestock and commodity prices, and higher production costs.

- There are still a number of economic uncertainties facing the U.S. and world economies which continues to make it a very challenging time to predict economic activity.

FY24 Revenue Estimate Revised UP from March 2023 Estimate:

As a reminder, FY24 began July 1, 2023. The REC increased its FY23 estimate from the March REC meeting by $102.5 million (1.06%). This increase equates to projected Net Receipts Plus Transfers of $9,752.8 million for the year, which reflects a 0.94% decrease in revenues as compared to FY23 (largely related to tax policy changes during the 2022 and 2023 sessions).

FY25 Revenue Estimate Revised DOWN From March 2023 Estimate:

As a reminder, FY25 begins on July 1, 2024, and ends June 30, 2025. The REC decreased its March FY23 estimate, as measured against the FY23 estimated revenues by $165 million (1.69%). Consequently, the revised estimate means total estimated revenues for FY25 are $9,576.3, an overall decrease of $176.5 million from the estimated FY24 numbers, or a reduction of 2.5%.