03-7-2023 |

Does Your Export Business Use an IC-DISC?

By: Christopher Nuss

Authorized by Congress as an incentive to promote export sales, Interest-Charge Domestic Sales Corporations (“IC-DISCs”) function as a simple, inexpensive, and low-risk tax planning strategy. Basically, IC-DISCs provide significant permanent tax benefits and deferred tax savings opportunities for U.S. based export companies by in essence allowing for dividends to be deductible. Despite the numerous recent federal tax changes, this strategy still offers significant tax saving opportunities due primarily to the gap between ordinary and capital gains tax rates.

What are the Requirements to form an IC-DISC?

To qualify as an IC-DISC, a U.S. domestic corporation must be formed under state law; have a single class of stock; maintain a minimum capitalization of $2,500; and meet strict annual qualified export receipts and qualified export assets tests (as discussed further below). The corporation must also maintain a separate bank account and accounting records, file U.S. tax returns, and make a valid election to be treated as an IC-DISC for federal tax purposes. If all of these requirements are met, then an IC-DISC is not subject to federal (and many states’) income tax on commission payments received from the exporting company. Instead, the shareholders of the IC-DISC are taxed on the distribution of those payments by the IC-DISC as dividends. In other words, the commission income is not taxed until the IC-DISC distributes the income to its shareholders, allowing the IC-DISC to retain commission income and defer taxes, subject to certain limitations (i.e., back to converting an otherwise non-deductible dividend to be deductible).

What are Qualified Export Receipts and Qualified Export Assets?

At least 95% of an IC-DISC’s gross receipts must be from the sale or lease of “export property” – that is property (1) manufactured, produced, grown, or extracted in the U.S. by a person other than an IC-DISC, (2) held primarily for sale in the ordinary course of business for use outside of the U.S., and (3) not more than 50% of its value is comprised of imported materials. This is not a difficult requirement to meet for companies that are exporting and does not mean that 95% of the exporting company’s receipts must be from exports. It simply requires that the IC-DISC be paid by the exporting company based on export sales. Through agreements between the exporter and the IC-DISC, we can ensure that the IC-DISC is paid based only on qualified export receipts.

Export property is considered “manufactured” if there is a “substantial transformation” before sale (e.g., irreversibly change the character or use of the original materials and add economical value to them, such as transforming steel rods into nuts and bolts), or the conversion costs account for at least 20% of the total cost of goods sold. Certain types of property simply do not meet the definition of “export property” such as most intellectual property (patents, inventions, designs, and the like) and products that deplete like oil, gas, and coal.

Importantly, qualifying exports may be delivered in the U.S. as long as the product is ultimately delivered outside the U.S. within a year for use outside the U.S. (so indirect sales can qualify as a qualified export receipt). Qualified exports, however, do not include property subject to further manufacturing or other processing after the sale and before ultimate delivery outside the U.S. Often, obtaining proper documentation for “indirect sales” is critical in this area.

As to qualified export assets, at least 95% of an IC-DISC’s assets at the end of each year must be assets held in connection with exporting activities such as working capital, receivables, and producer’s loans. Again, this is generally not a difficult requirement to meet through proper agreements among the applicable parties.

What are the Potential Benefits of an IC-DISC?

At a high level, the tax benefits of an IC-DISC result from converting sales income to qualified dividend income. Thus, instead of being taxed at ordinary income rates, the income is taxed at the substantially lower qualified dividend rates. For individuals, directly or indirectly through pass-through entities such as limited liability companies or S corporations, an IC-DISC may reduce their tax rate on export profits from the ordinary income tax rate (maximum of 37% for 2023 plus the extra Medicare tax for high-earners of 0.9%) to the dividend rate (maximum of 20% plus the extra tax on investment income of 3.8%) – an approximate savings on tax rates of around 14%, each year. Similarly, closely held C corporations can also benefit from implementing an IC-DISC with what essentially becomes a tax-deductible dividend, especially if they declare and pay dividends to shareholders anyway. IC-DISC flexibility can also aid in wealth transfer or executive compensation arrangements for the exporting company.

How Does an IC-DISC Typically Work?

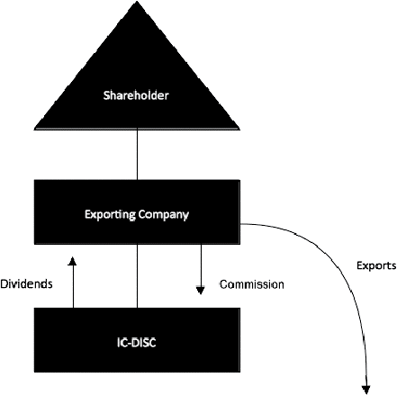

Assuming the exporting company is an S corporation (or other pass-through entity) that wholly owns the IC-DISC as set forth in the diagram below, the S corporation exports the goods and pays the IC-DISC a commission based on those export sales that is deductible for income tax purposes and not taxed to the IC-DISC, a tax-exempt entity. Then, the IC-DISC typically distributes back to the S corporation that same amount, which passes through to the S corporation’s shareholders and is taxed to them at the dividend rate, not the ordinary income tax rate that it otherwise would have been without the IC-DISC. Thus, the S corporation shareholders have paid less tax on these commissions equal to the difference in the applicable ordinary income tax and dividend tax rates. And this is a permanent savings (unless/until Congress changes the applicable tax rates).

The amount of the “commission” cannot exceed the greater of 50% of the export taxable income or 4% of export gross receipts. In determining export taxable income, certain directly and indirectly related expenses can be allocated and apportioned between export and non-export activities to maximize tax savings. If one of these two formulas is followed, you can generally avoid the risk and uncertainty of the IRS transfer pricing rules. Further, to determine your export taxable income, there is flexibility in how you categorize sales – for example, by product line or even by transaction – to optimize your commission calculation (and thus optimize your tax savings).

Unlike other tax planning strategies, the IRS recognizes that IC-DISCs are not required to have economic substance (e.g., maintain an office or have its own employees and operations) generally because of the desire to incentivize the export of U.S.-manufactured goods. In a recent opinion, the United States Court of Appeals for the Ninth Circuit reinforced the value of IC-DISCs as a tax planning tool and solidified the notion that IC-DISCs are not required to have economic substance. Among other things, the Court considered whether the economic substance-over-form doctrine should apply where Congress has explicitly authorized transactions that lack economic substance. In that case, Mazzei v. Commissioner, 998 F.3d 1041 (9th Cir. 2021), the Ninth Circuit answered no, ruling in favor of the taxpayer, and joining the First, Second and Sixth Circuits in rejecting the IRS argument that the form of a transaction lacking economic substance should be disregarded. The Court held that the substance over form doctrine cannot undermine Congress’s explicit authorization. The Court explained, “it is not our role to save the Commissioner from the inescapable logical consequence of what Congress has authorized.” While the focus of the Mazzei decision was on Foreign Sales Corporations, rather than IC-DISCs, the Court emphasized that the same logic applies to similar entities.

An IC-DISC is not difficult to form with the help of experienced legal counsel, and is not overly burdensome, especially given the immediate tax savings that can be realized under the right circumstances. To further discuss and analyze whether an IC-DISC is right for your business, please contact Christopher L. Nuss or your primary BrownWinick attorney.

This article was written for general informational purposes only. As such, it should not be relied upon for compliance with the Internal Revenue Code of state tax laws.

Meet the Authors: