12-14-2021 |

Government Relations Update - 12-14-21

By: BrownWinick

December 13, 2021

REC SUMMARY

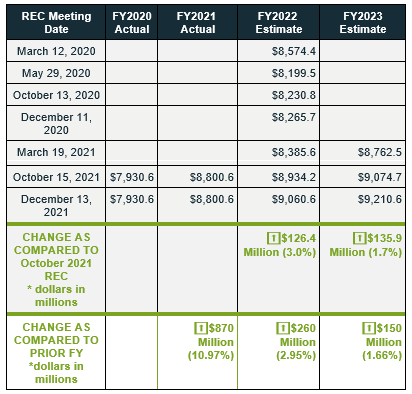

The Revenue Estimating Conference (REC), comprised of a three-member panel (Kraig Paulsen, Department of Management; Holly Lyons, Legislative Fiscal Agency; and David Underwood, Public Member) met yesterday (12/13/21) to estimate future state revenues. The REC approved the Legislative Service Agency’s (LSA) FY22 estimates as presented in the attached spreadsheet (no change). However, the REC made the following changes to LSA’s FY23 estimates: 1) reduced Personal Income Tax by $54 million; 2) reduced Corporate Income Tax by $40 million; and 3) increased Sales/Use Tax by $14 million. The adjustments moved the Net Receipts Plus Transfers number from $9,290.6 to $9,210.6 ($80 million net decrease). Thus, growth for FY23 changed from 2.5% to 1.7%.

Important to Note: The REC’s number is purely an estimate. Governor Reynolds uses the December 2021 estimate to prepare her budget. The Legislature is required to use the lower of the December 2021 or March 2022 estimates for its upcoming fiscal year (FY) 2023 budgeting.

Summary: The REC’s report shows that revenues for the current fiscal year (FY22) are estimated to be $9,060.6 million, higher by 126.4 million than estimated during the October 15, 2021 REC meeting. This means there are estimated to be $260 million “new dollars” for FY22 as compared to FY21. Revenues projected for the upcoming fiscal year (FY23), which starts July 1, 2022, are estimated at $9,210.6 million, higher than the October estimate by $135.9 million. This means there are an estimated $150 million “new dollars” for FY23 as compared to FY22, or 1.7% growth for next year. For additional background and perspective, we have included the October 15, 2021; March 19, 2021; and December 11, 2020 REC summaries below.

General Comments from the REC Regarding Factors Impacting Estimates:

- The State of Iowa, the nation, and beyond are experiencing an economy in transition. Some of these changes have been caused by, or accelerated, by the COVID-19 pandemic. The pandemic has also created a change in consumer purchasing expectations. These expectations are being driven by labor shortage, supply chain challenges, and rising inflation.

- Job numbers for both the country and Iowa are still well below pre-pandemic levels. It will likely take the U.S. about 7 months to reach former employment peak. However, it will likely take Iowa over two years.

- Iowa continues to have more jobs than workers which is compounded by the pandemic with some people choosing not to return to the workforce for a variety of reasons.

- Iowa’s unemployment is at 3.9% with a 66.8% labor participation rate that continues to lag previous highs.

- Approximately 64,000 Iowans are looking for work with 110,000 available job openings.

- While employment is still down compared to 2020, wage and salary totals for Iowa do not seem to be impacted to the same degree. Salaries are on the rise.

- Supply Chain issues are in the news nonstop.

- Almost 100 ships are sitting off the coast of California waiting to be unloaded.

- The nation is experiencing a truck driver shortage, low retail inventories, and low manufacturers facilities’ inventory.

- The Bureau of Labor Statistics identified the current inflation surge of 6.8% as the largest 12-month jump since the beginning of 1982. This inflation, which was once thought to be transitory, and maybe even necessary, to fuel the struggling economy has been partly caused by the supply chain bottle neck and the inability of businesses to meet consumer demand.

- The cause and effect of the inflation numbers or how long it last can be debated, but the truth is it is uncertain. Product prices and state revenue traditionally move together.

- Iowa’s agriculture economy continues to benefit from high prices and good corn/soybean volumes.

- Real GDP growth continues at an annualized rate of 7.7%.

- Another headwind facing the Iowa economy is the unknown impact of the Omicron and future unknown variants of COVID-19.

- The number of deaths and significant illnesses must come down for the economic picture to stabilize.

FY22 Revenue Estimate Revised UP from October 2021 Estimate:

- As a reminder, FY22 ends June 30, 2022. The REC increased its estimate from October 2021 by 126.4 million. This increase equates to projected Net Receipts Plus Transfers of $9,060.6 million, which reflect a 3.0% increase in revenues (or $260 million new) as compared to FY21.

FY23 Revenue Estimate Revised UP from October 2021 Estimate:

- As a reminder, FY22 begins on July 1, 2022 and ends June 30, 2023. The REC revised up its FY23 estimate, as measured against the FY22 estimated revenues, by $135.9 million. Consequently, the REC’s revised estimate means total estimated revenues are $9,210.6 million for FY23, an overall increase of $150 million from the FY22 numbers.

[END OF DECEMBER 13, 2021 REC SUMMARY]

October 15, 2021

REC SUMMARY

The Revenue Estimating Conference (“REC”), comprised of a three-member panel (Kraig Paulsen, Holly Lyons, and David Underwood) met this morning (10/15/21) as part of their standard schedule of meetings to estimate future state revenues. A summary of the information discussed during the meeting is below, along with the attached spreadsheet distributed before the meeting, which contains more detailed revenue information. You can view a recording of the full meeting here.

Important to Note: Today's REC number is purely an estimate. Recall, Governor Reynolds uses the December estimate to prepare her budget. The Legislature is required to use the lower of the December and March estimates for its fiscal year (“FY”) 2023 budgeting.

Summary: Iowa’s state revenues grew tremendously over the past year. Specifically, fiscal year 2021 (FY21) actual revenues shot up $870 million over FY20 revenues, which equates to nearly 11% growth. Today’s meeting also shows that revenues for FY22 are estimated to grow by $133.6 million, showing an anticipated 1.5% growth for FY22. Keep in mind, this estimated 1.5% growth for FY22 is on top of the nearly 11% actual growth of revenues between FY20 and FY21. For additional background and perspective, I have included the March 19, 2021, December 11, 2020, and October 13, 2020 REC summaries below.

General Comments From the REC Regarding Factors Impacting Estimates:

- In both dollar and percentage terms, fiscal year 2021 growth exceeded any year since at least fiscal year 2001;

- After FY20’s low rate of growth due to COVID, FY21 was a strong rebound, largely concentrated in the final three months of the FY;

- General Fund net revenues increased $870 million, or 11% as compared to FY20 and exceeded REC estimated by $737.1 million or 9%;

- In Iowa, just 2 of the federal stimulus programs pumped $11 billion dollars into Iowa economy since start of recession in 2020;

- Delta variant continues to disrupt the US economy and slowed 3rd quarter calendar year growth and is expected to inhibit growth through end of year;

- Iowa’s GDP expanded 7.7% in the second quarter of 2021;

- US and Iowa job numbers are below pre-pandemic levels and it could take Iowa longer than the national average, and up to 2 years, to return to pre-pandemic levels;

- While Iowa unemployment reached a high of 11% in 2020, it is currently at 4.1%, much improved but still behind the 2.9% pre-pandemic levels;

- Increases in corn and bean prices are good for the Iowa agriculture economy;

- Iowa’s budget reserves are full and we ended the fiscal year with a large surplus;

- While some headwinds are facing the global economy and to a certain extent the Iowa economy, Iowa remains in a strong financial position.

- Through last Monday, FY22 revenue is up $80 million, or 5%;

- Crops are coming in much better than expected (yields are higher than anticipated);

- A brighter and very strong future for Iowa; current revenues are strong and we have a strong foundation to build from, and data shows growth into the future: Sales and use tax receipts are showing remarkable growth at 18%;

- Workforce participation rates are below pre-pandemic levels and it’s not clear how soon they will return, but clearly room for growth;

- More jobs openings than those seeking employment - consequently, lots of room to the upside;

- Real GDP has now surpassed pre-pandemic levels in the state and nationally;

- Supply chains currently very stressed and only room to grow;

- Personal savings rate, while receded from highs during the pandemic, still above pre-pandemic levels, which signals significant pent up demand for consumer and business spending;

- Wage growth is occurring and will continue to grow into the foreseeable future;

- Inventories are unsustainably low, another pre-cursor to growth;

- Exports remain strong;

- Farmland prices are near record highs;

- Fuel costs are a concern and rising energy costs could be a drag on growth if not addressed in an appropriate manner.

FY22 Revenue Estimate Revised UP from March 2021 Estimate:

- As a reminder, FY22 ends June 30, 2022. The REC increased its FY22 estimate from the March REC meeting by $548.6 million. This increase equates to projected Net Receipts Plus Transfers of $8,934.2 million, which a reflects 1.5 increase in revenues as compared to FY21.

FY23 Revenue Estimate Revised UP From March 2021 Estimate:

- As a reminder, FY23 begins on July 1, 2022 and ends June 30, 2023. The REC revised up its March REC meeting FY23 estimate, as measured against the FY22 estimated revenues, by $312.2 million. Consequently, today's revised estimate means total estimated revenues are $9,074.7 million for FY23, an overall increase of $140.5 million from the FY22 numbers, or 1.6% growth.

[END OF OCTOBER 15, 2021 REC SUMMARY]

March 19, 2021

REC SUMMARY

The REC (a three member panel comprised of Michael Bousselot, Holly Lyons, and David Underwood) met this morning (3/19/21) as part of their standard schedule of meetings to estimate future state revenues. A summary of the information discussed during the meeting is below, along with the attached spreadsheet distributed before the meeting, which contains more detailed revenue information.

Important to Note: Today's REC number is purely an estimate. Recall, the Governor uses the December 2020 estimate to prepare her budget. The Legislature is required to use the lower of the December 2020 and March 2021 estimates for its upcoming fiscal year (“FY”) 2022 budgeting.

Summary: In short, today’s report shows that revenues for the existing fiscal year (FY21) are estimated to be $8,078.9 million, higher by $109.6 million than estimated during the December 11, 2020 REC meeting. This means there are estimated to be $148.3 million new dollars for FY21 as compared to FY20 (or 1.9% revenue growth). Revenues projected for the upcoming fiscal year (FY22), which starts July 1, 2021, are estimated at $8,385.6 million, higher than the December estimate by $119.9 million (3.8% revenue growth). This means there are estimated to be $306.7 million "new dollars" for FY22 as compared to FY21. Based upon these numbers, the legislature will be required to use the December 2020 estimate given it is the lower of the March and December estimates. For additional background and perspective, I have included the December 11, October 13, May 29, and March 12, 2020 REC summaries below.

General Comments From the REC Regarding Factors Impacting Estimates:

- Since they met in December 2020, more rounds of stimulus checks and other federal assistance have flowed into the state. The impact of the most recent stimulus remains to be seen in Iowa;

- Unemployment remains well below pre-pandemic levels;

- There is much pent-up demand for spending, travel, services, and entertainment;

- There are some concerns about pent-up demand driving up inflation;

- Iowa’s economy has been remarkably resilient to the covid-19 induced recession, largely because of finance and insurance, agriculture, and manufacturing and these sectors were not as vulnerable to the downturn as travel and leisure;

- Recent months have seen a slow down in job growth here in Iowa;

- In the non-farm jobs category, we are currently 77,000 jobs below January 2020;

- Iowa’s employment-to-population ratio has been dropping and we are near the farm crisis ratio of the 1980s - in Iowa, it is likely that many of these people are older, retired, or don’t want to work;

- Corn and soybean prices are higher and it is anticipated they will remain higher throughout the year;

- Iowa’s budget reserves are full and higher than other states;

- In discussions with employers, about half of them would hire more people if they could find them;

- Supply shortages - from building materials to computer chips - is impacting manufacturing in Iowa and potentially puts downward pressure on growth;

- Prices are starting to rise on steel because of tariffs and new home construction is increasing due to lumber shortages, equating to about a $24,000 increase for the average home;

- Biden tax increase talks have injected some uncertainty into the economy at a point in time where we didn’t need much more uncertainty;

- Our land borders with Canada and Mexico are still closed and will be closed for some additional time;

- Iowa’s economy has been resilient and persistent, and if you look at today’s numbers they show revenue growth for Iowa, year-over-year;

- KPMG reported that Iowa is among the lowest risk and most resilient economies in the nation coming out of COVID19;

- Jobs in Iowa exist and unemployment remains low vis-a-vis nation;

- Stimulus checks will undoubtedly have an impact on sales tax revenues for the state in the near term;

- Applaud the roll out of the vaccine in Iowa - on April 5th all Iowans will be eligible; and

- 65,000 jobs are currently listed in Iowa according to the workforce development website.

FY21 Revenue Estimate Revised UP from December 2020 Estimate:

- As a reminder, FY21 ends June 30, 2021. The REC increased its estimate from December 2020 by $109.6 million. This increase equates to projected Net Receipts Plus Transfers of $8,078.9 million, which a reflects 1.9% increase in revenues (or $148.3 million new as compared to FY20).

FY22 Revenue Estimate Revised UP From December 2020 Estimate:

- As a reminder, FY22 begins on July 1, 2021 and ends June 30, 2022. The REC revised up its FY22 estimate, as measured against the FY21 estimated revenues, by $119.9 million. Consequently, today's revised estimate means total estimated revenues are $8,385.6 million for FY22, an overall increase of $306.7 million from the FY21 numbers, or 3.8% growth.

FY23 Revenues Estimate:

- The REC also estimated revenues for FY23. Recall, FY23 begins on July 1, 2022 and ends on June 30, 2023 - 863 days from today. The REC estimated $8,762.5 million or 4.5 % growth for FY23 over the FY22 estimate - totaling $376.9 million new dollars as compared to the FY22 estimated revenues.

[END OF MARCH 19, 2021 REC SUMMARY]

December 11, 2020

REC SUMMARY

The REC (a three member panel comprised of Dave Roederer, Holly Lyons, and David Underwood) met this afternoon (12/11/20) as part of their standard schedule of meetings to estimate future state revenues. A summary of the information discussed during the meeting is below, along with the attached spreadsheet distributed before the meeting, which contains more detailed revenue information.

In short, today’s report shows that revenues for the existing fiscal year (FY21) are estimated to be $7,969.3 million, higher by $57.6 million than estimated during the October 13, 2020 REC meeting. This means there are estimated to be $38.7 million new dollars for FY21 as compared to FY20. Revenues projected for the upcoming fiscal year (FY22), which starts July 1, 2021, are estimated at $8,265.7 million, higher than the October estimate by $34.9 million. This means there are estimated to be $319.1 million "new dollars" for FY22 as compared to FY21, or 3.7% growth for next year. For additional background and perspective, I have included the October 13, May 29, and March 12, 2020 REC summaries below.

Important to Note: Today's REC number is purely an estimate. Recall, the Governor uses the December 2020 estimate to prepare her budget. The Legislature is required to use the lower of the December 2020 and March 2021 estimates for its upcoming fiscal year (“FY”) 2022 budgeting.

General Comments From the REC Regarding Factors Impacting Estimates:

- FDA final approval is imminent and vaccine rolling out soon; however, roll out is a process and definitely a light at the end of the tunnel, but the tunnel is not short;

- Continued stimulus will be key to sustaining economy, but stimulus may be delayed until January;

- Looking at non-farm employment numbers, Iowa is mirroring US economy and gained back 1/2 of the jobs lost during Covid recession. Still below the 2019 number, however, by 75,000 jobs;

- Iowa employment population ratio has dropped from 69% to 63.5% in last year, indicating that 5.5% have dropped out of the labor force;

- Farm income looks very good and better than any year since 2013 and the size of the corn crop is 90% of 2019 and soybean are 100% of 2019 levels;

- Iowa is strong in industrial manufacturing, finance, insurance, and agriculture. These sectors have fared fairly well during the pandemic, all things considered;

- Estimates show slow economic recovery over next couple years. Estimate for FY21 calls for slightly negative revenue growth between now and the end of the fiscal year (but need to consider revenues currently in the bank for first 1/2 of year, which allows some growth);

- Iowa has the 3rd lowest employment rate in the nation, which is great, but still not back to pre-covid levels;

- Economic fundamentals continuing to show signs of modest strength. Nearly $5 billion dollars in our economy through federal programs has helped those in needs and businesses;

- Agriculture was challenged prior to the pandemic, then the derecho, which was devastating. But as we’ve come out of this, we’re heading into a profitability area in agriculture. If our current export commitments are fulfilled by our trading partners and if COVID distribution has minimal difficulties, the restrictions will be lifted in various parts of the world, the Ag sector will be on a stronger footing in 2021;

- Children are occasionally back in school and vaccine arriving in matter of days and ISU had best record in the BIG 12 - all positives that should help with our recover;

- We know we will come out of this, who would have thought the word positivity could have a negative meaning like it does to the pandemic;

- The question really is… do we need economists or psychiatrists to help us determine what is going to happen? Because the economics may say one thing, but it’s really going to get down to whether people believe the pandemic is coming to an end and whether they feel secure enough to invest their money into good and services.

FY21 Revenue Estimate Revised UP from October 2020 Estimate:

- As a reminder, FY21 ends June 30, 2021. The REC increased its estimate from October 2020 by $57.6 million. This increase equates to projected Net Receipts Plus Transfers of $7,969.3 billion, which a reflects -.5% increase in revenues (or $38.7 million new) as compared to FY20.

FY22 Revenue Estimate Revised UP From October 2020 Estimate:

- As a reminder, FY22 begins on July 1, 2021 and ends June 30, 2022. The REC revised up its FY22 estimate, as measured against the FY21 estimated revenues, by $34.9 million. Consequently, today's revised estimate means total estimated revenues are $8,265.7 for FY22, an overall increase of $319.1 million from the FY21 numbers.

[END OF DECEMBER 11, 2020 REC SUMMARY]